Total Addressable Market - TAM Definition, Measurement & More

Learn how to calculate your Total Addressable Market (TAM) using top-down, bottom-up, and value-theory approaches to fuel business growth.

You're a SaaS company looking to build and sell great products. But how many potential buyers are out there? How many ideal clients are currently in-market? And what sort of revenue can you expect to generate from this market?

Measuring your Total Addressable Market is the first step in answering these questions and building a sustainable business. This article highlights everything you need to know about TAM: what it is, how to measure it, and how to analyze it for optimized growth.

TL;DR

- TAM estimates the maximum revenue opportunity for a business based on market size and customer spending.

- Common calculation methods include top-down (industry data), bottom-up (internal revenue trends), and value-theory (customer-perceived value).

- TAM analysis supports market entry decisions, product development, and revenue forecasting.

- SaaS companies benefit from tools that reveal in-market website visitors, helping capture a larger portion of their TAM.

What is Total Addressable Market?

Total Addressable Market (TAM) refers to a company’s maximum potential revenue opportunity. It’s the total amount of sales that can possibly be done by a business based on the market for a product.

At a high-level, TAM can be calculated using the formula: TAM = total number of possible customers in the market x annual contract value of each customer

For example, let’s take a project management software tool for small and medium-sized businesses (SMBs). Given that there are 2 million SMBs in the world, and each one spends $1000 a year on project management tools, the Total Addressable Market for this product would be 2M X $1000, or $2 billion.

In other words, TAM represents the revenue generated by the company if it captures 100% of the market share. Of course, this is just an estimate of the size of the market, without accounting for competitors, economic conditions, and countless other factors that will affect revenue generation. Yet, as the next section explains, TAM provides important directional insights to help your business grow.

Why is TAM analysis important?

Calculating the total addressable market can serve different purposes at different stages of growth. At the ideation stage of a business, calculating the TAM helps assess the size and viability of the market for your product. If, for example, your TAM is only about $1 million, you’ll likely hit a ceiling for revenue growth within a few short years.

As the company grows, understanding your total addressable market can support the direction of your company road map. TAM helps evaluate the size of your market when considering new product features, priorities, channels and revenue streams over time. Whether it’s geographic expansion, product development, or forward integrations, TAM helps project growth in later stages of your startup’s journey.

At any point in your company’s growth, knowing your total addressable market will help evaluate how much of the market share you’ve successfully captured. It helps create healthy expectations and achievable benchmarks for your team and your company.

A Step-By-Step Guide on How to Calculate TAM

There are three popular methods to calculate TAM: the top-down approach, the bottom-up approach, and the value theory approach. Each method is uniquely helpful based on the scenario.

- Top-down approach: This is best suited for early-stage teams looking for a preliminary assessment of the viability of entering a market.

- Bottom-up approach: This is best suited for high-growth startups that can leverage insights from historical customer data and revenue trends.

- Value-theory approach: A third TAM analysis that considers the potential value that customers derive from a product and service, and it helps back-calculate the total addressable market accordingly.

Top-Down Approach

In this method, the initial consideration revolves around estimating the price for the product. This value is subsequently multiplied by the total number of prospective customers.

A company that is looking to evaluate the need for their product can rely on this approach to estimate market share. It is also a great way to establish a profitable business model when looking for investor funding.

To illustrate this concept, let's take the example of a SaaS CRM product targeting small and medium-sized businesses (SMBs). Here is a simplified version of the top-down approach when calculating TAM:

Step 1: Define the Parameters

Market Definition: The market we're interested in is the CRM software market for SMBs.

Market Size Data: Research indicates that there are approximately 30 million SMBs.

Average Annual Spend: On average, SMBs spend around $1,000 per year on CRM software.

Step 2: Calculate TAM

Now, we can calculate the TAM using the top-down approach:

TAM = Total Number of Potential Customers × Average Annual Spend per Customer

TAM = 30 million SMBs × $1,000 per year

TAM = $30 billion per year

Step 3: Interpretation

The TAM for this SaaS CRM product for SMBs is approximately $30 billion per year. This figure represents the maximum market potential without any constraints. It indicates that if the SaaS company could capture 100% of this market, its annual revenue potential could reach $30 billion.

Bottom-Up Approach

The bottom-up approach involves defining your target customers, estimating revenue per customer, and then extrapolating this revenue across your entire target market to calculate TAM. It's a detailed and customer-focused method that can be valuable for SaaS companies looking to assess their market potential with a high degree of specificity.

Using the same example,

Step 1: Identify Your Target Customer Base

In the bottom-up approach, you start by identifying your target customer base precisely. For a CRM company, even though its ideal target audience is SMBs, it may not be suitable for certain industries, where the sales cycle is very short and there are no repeat purchases. Hence, we might boil down the customer base to SMB B2B companies alone.

Step 2: Calculate the Average Revenue per Customer

Next, calculate the average revenue per customer. You might consider factors such as pricing tiers, subscription models, and any additional services or upsells. Let's assume the SaaS company offers three pricing tiers for its CRM software:

- Basic Tier: $20 per user per month

- Standard Tier: $50 per user per month

- Premium Tier: $100 per user per month

Assuming an average of 10 users per SMB subscribing to the CRM software, we can calculate the average monthly revenue per customer:

Average Monthly Revenue per Customer = [(Number of Basic Tier Customers × $20) + (Number of Standard Tier Customers × $50) + (Number of Premium Tier Customers × $100)] / Total Number of Customers

Step 3: Estimate the Number of Potential Customers

Now, estimate the number of potential customers in your target market. For this example, let's say there are approximately 5 million B2B SMBs to target:

Step 4: Calculate TAM

With the average monthly revenue per customer and the estimated number of potential customers, you can calculate TAM for the CRM software:

TAM = Average Monthly Revenue per Customer × Number of Potential Customers × 12 (to get the annual figure)

TAM = [(Number of Basic Tier Customers × $20) + (Number of Standard Tier Customers × $50) + (Number of Premium Tier Customers × $100)] / Total Number of Customers × Number of Potential Customers × 12

Value Theory Approach

In the value theory approach, you are essentially calculating TAM by assessing the value proposition of your SaaS product to different customer segments and estimating their willingness to pay based on the perceived value. This approach provides a more customer-centric and value-focused perspective on market potential, allowing you to tailor your pricing and marketing strategies to different customer segments based on varying needs and expectations.

Using the same example,

Step 1: Identify Customer Segments and Their Needs

Begin by identifying different customer segments within your target market and understanding their specific needs. For our SaaS CRM software, customer segments might include small businesses, medium-sized businesses, and startups.

Step 2: Quantify the Value Delivered

For each customer segment, assess the value your CRM software provides. This value could be quantified in various ways, such as increased productivity, improved customer relationships, time savings, or cost reductions. For example:

Small businesses may value the CRM software for streamlining their sales processes, resulting in increased sales and revenue.

Medium-sized businesses may value the software for better customer data management, leading to more effective marketing campaigns and customer retention.

Step 3: Estimate the Willingness to Pay

Determine how much customers in each segment are willing to pay for your CRM software. This can involve conducting surveys, market research, or analyzing competitors' pricing strategies. Let's assume that small businesses are willing to pay an average of $50 per user per month for the CRM software, while medium-sized businesses are willing to pay $100 per user per month.

Step 4: Calculate TAM

Now, calculate the TAM for each customer segment by multiplying the number of potential customers in that segment by the average monthly revenue per customer:

TAM for Small Businesses = Number of Small Businesses × Average Monthly Revenue per Customer for Small Businesses

TAM for Medium-sized Businesses = Number of Medium-sized Businesses × Average Monthly Revenue per Customer for Medium-sized Businesses

Sum up the TAMs for all customer segments to get the overall TAM for your CRM software:

TAM = TAM for Small Businesses + TAM for Medium-sized Businesses

Challenges with TAM Analysis

Calculating TAM using the bottom-up approach and the value theory approach is nuanced and relies heavily on historical data and a deep understanding of customer behavior. The analysis can present certain challenges, mainly:

Limited Data Availability

Gathering accurate data on the number of potential customers, their segmentation, and willingness to pay can be challenging, especially if there's limited market research available or if the industry is highly fragmented.

Pricing Complexity

Determining the right pricing strategy and accurately estimating the average revenue per customer can be complex. It may require considering different pricing tiers, discounts, and the potential impact of competitors' pricing.

Inaccurate Customer Segmentation

Identifying and categorizing different customer segments with precision can be difficult. Overlooking or misclassifying segments tend to lead to inaccurate TAM calculations.

Changing Market Dynamics

Markets are dynamic, and customer preferences, needs, and behaviors will change over time. Keeping up-to-date data and adapting to evolving market conditions is easier said than done.

Data Bias

Data collection may suffer from bias, especially if the company relies on its own internal data, which might not capture the full spectrum of customer opinions and experiences, which is required to carry out a value theory analysis.

And there you have it!

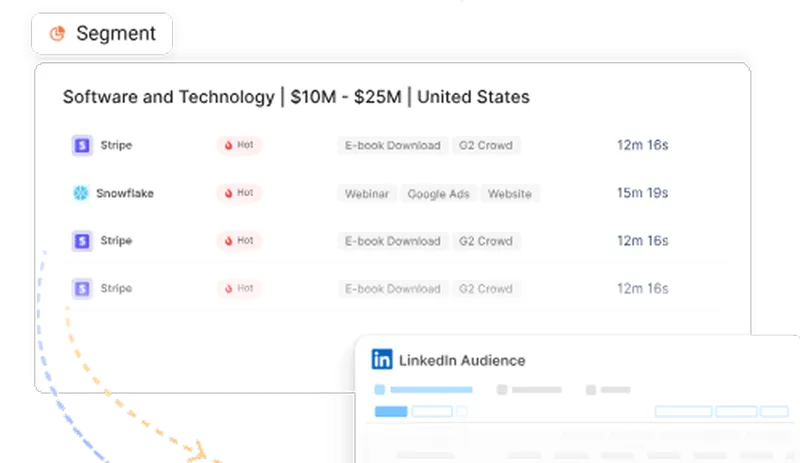

Needless to say, in an incredibly competitive SaaS environment, even the most successful companies capture the attention of only a fraction of their TAM. And an even smaller subset of these accounts actually become customers. In fact, even the most optimistic benchmarks find that only 4% of website traffic converts through sign-ups. Factors helps identify, qualify, and convert the remaining 96% of anonymous accounts visiting your website — so you can capture more of your TAM, than ever before.

Understanding and Measuring Total Addressable Market (TAM)

Total Addressable Market (TAM) represents the maximum revenue opportunity available for a product or service if a company were to achieve 100% market share. Calculating TAM is crucial for startups and growing businesses to assess market potential, secure funding, and shape long-term strategies.

TAM can be estimated using three methods:

- Top-Down Approach: Uses industry data to estimate the overall market size, suitable for early-stage assessments.

- Bottom-Up Approach: Relies on internal sales data and pricing models to project market potential, often preferred by growing companies.

- Value-Theory Approach: Estimates TAM based on the perceived value a product delivers to different customer segments, helpful for innovative or disruptive products.

Accurate TAM analysis informs product development, market expansion, and revenue forecasting. However, challenges such as data limitations, pricing variability, and market shifts can complicate the process. Combining multiple approaches often yields the most reliable insights.

For SaaS businesses, identifying and engaging the right segment of TAM is key, as only a small percentage of potential customers convert. Tools that reveal in-market, anonymous website visitors can bridge this gap, unlocking more opportunities within your TAM.

See how Factors can 2x your ROI

Boost your LinkedIn ROI in no time using data-driven insights

See Factors in action.

Schedule a personalized demo or sign up to get started for free

LinkedIn Marketing Partner

GDPR & SOC2 Type II

.svg)

.jpg)